Dear Parent,

Does your child dream big? Are they curious about money, business, and building their future?

OR

Are Any of These Your Concern as a Parent?

- Your child thinks money "just comes from the bank" or credit cards

- They constantly ask for expensive toys and games without understanding value

- You worry they're not learning crucial money skills in school

- Traditional money lessons feel boring and disconnected from today's world

- You want your child to understand entrepreneurship but don't know where to start

- You're concerned about your child's financial future in an increasingly complex economy

- Teaching financial responsibility feels overwhelming, especially when balancing work and family

If you answered YES to any of the above, now is your chance to give them the gift of financial wisdom from someone who speaks their language.

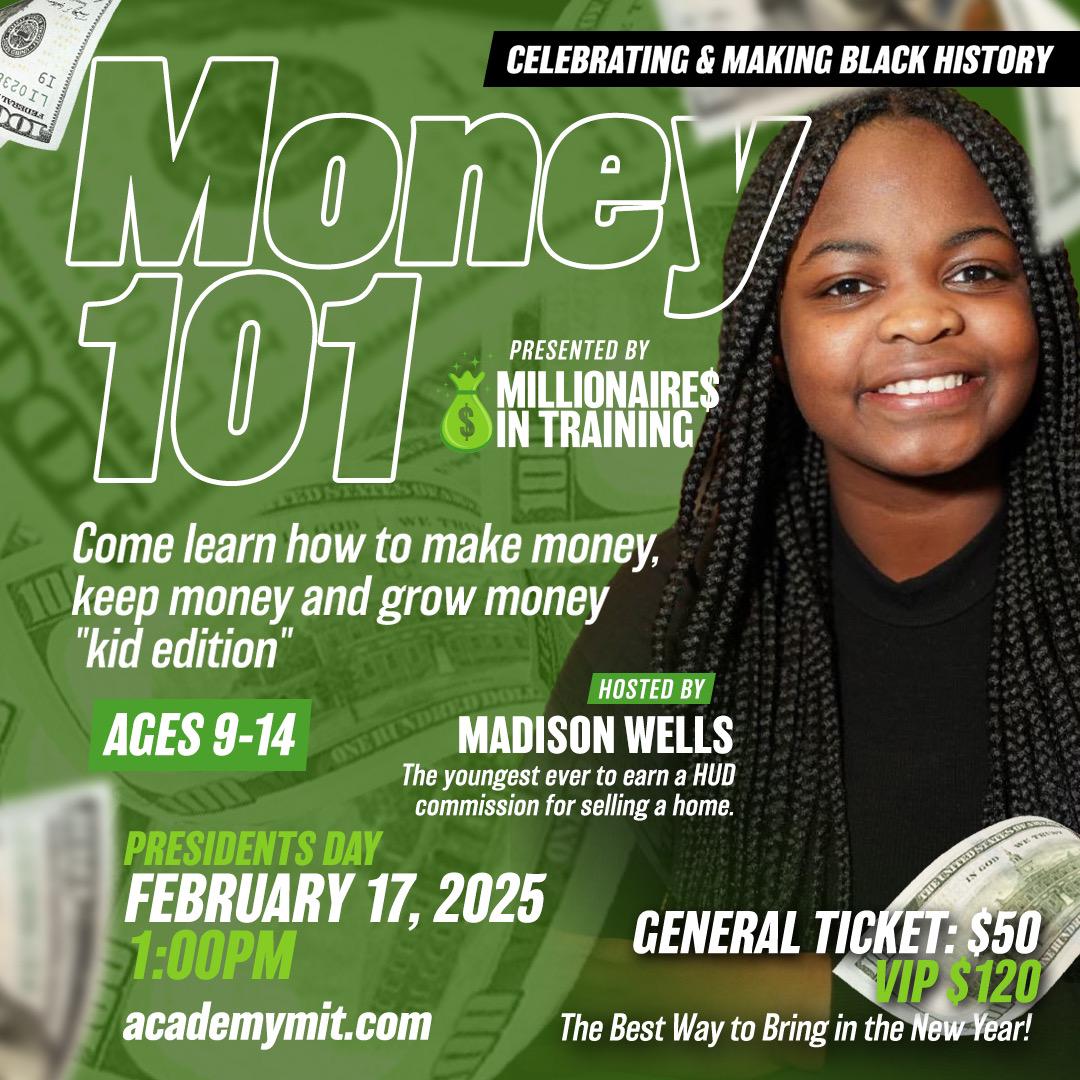

The Solution: Real Financial Education from a Real Kid

Meet Madison, a 10-year-old who's already mastering the money skills most adults wish they'd learned earlier. She's not just another child – she's a young entrepreneur who:

- Manages her own bank account with sound saving strategies

- Earns regular income through professional dog grooming work

- Successfully closed a real estate deal as a family sales representative

- Understands the value of money and makes wise spending decisions

Why Madison's Class Works Where Others Fall Short:

✓ Kids Learn from a Peer: No more glazed eyes or "Mom/Dad just doesn't get it" ✓ Real-World Experience: Not theoretical lessons, but practical skills from someone actually doing it

✓ Relatable Examples: Madison shares stories about earning money doing things kids can actually do

✓ Age-Appropriate Content: Complex concepts broken down by someone who remembers what it's like to not understand

✓ Immediate Application: Students leave with actionable plans, not just concepts

Transform Your Child's Financial Future

Imagine your child:

- Understanding the true value of money and making smart spending choices

- Starting their own mini-business ventures with confidence

- Saving money automatically without constant reminders

- Making informed decisions about their allowance or earnings

- Having the entrepreneurial mindset to spot opportunities

- Building habits that will serve them for life

What Your Child Will Learn:

- Smart Money Basics: What is money and how money works

- How to make money

- How save, spend wisely, and make their money grow

- Having to create and manage a budget

- Entrepreneurial Mindset: Identifying opportunities and taking action

- Banking Fundamentals: Understanding accounts, savings, debt cards and basic financial tools

- Payable Skills: Real examples from Madison's dog grooming and real estate experience

- Goal Setting: How to turn big dreams into achievable plans

General Admission

$

50

-

Access to the live training & workbook

-

Access to the MIT Academy community

VIP

$

120

-

Access to the live training & workbook

-

Access to the recordings for 6 months

-

Access to the MIT Academy community

-

-

BONUSES (descriptions below):

-

30 min. 1-on-1 session with Madison & her mom Alisha.

-

-

-